Plan for Care Costs and Unexpected Expenses

Healthcare expenses can be one of the most significant financial concerns in retirement.

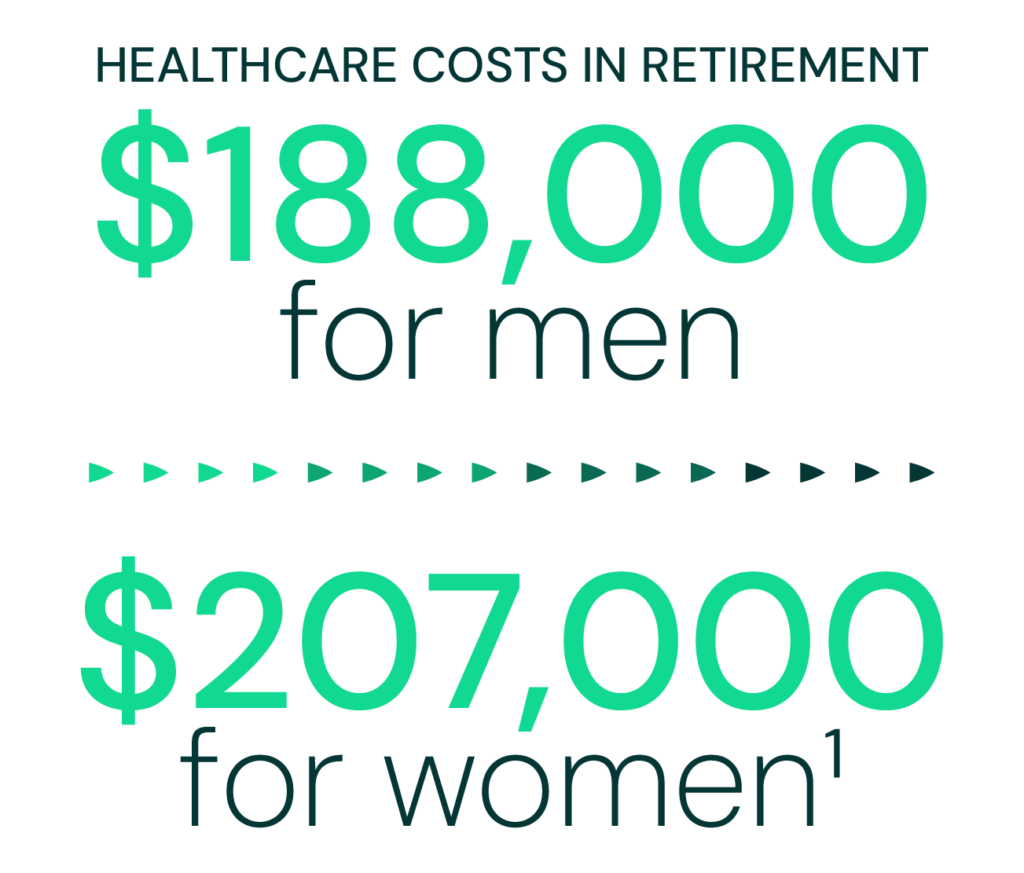

A healthy 65-year-old couple retiring in 2024 could spend around $395,000 on healthcare throughout retirement—$188,000 for men and $207,000 for women.1

Which means, planning ahead is essential to managing the impact.

Here’s how to get started:

Preparing for Healthcare Costs

Pre-Retirement

Living a healthy lifestyle is one of the most effective ways to manage future healthcare costs.

Prioritizing regular physical activity, maintaining a balanced diet, and following preventive care recommendations can help lower your risk of chronic conditions that could be costly now and even more so in the future.

But good health alone isn’t enough.

If you’re eligible, consider using a Health Savings Account (HSA). HSAs offer tax advantages, allowing you to save for future medical expenses with pre-tax dollars. Contributions, growth, and withdrawals for qualified expenses are tax-free, and unused funds roll over each year, giving you a growing resource for healthcare needs.

Delaying Social Security benefits may be another way to strengthen your financial position. By postponing benefits past your full retirement age, you can increase your monthly income by about 8% per year up until age 70—giving you more income to cover rising healthcare costs in retirement.

If delaying Social Security would create a shortfall in your income, discuss with your financial professional how an annuity can help bridge that gap.

Making Sense of Your Options

Covering care costs often means pulling from multiple income sources.

In addition to Medicare and Social Security, your retirement accounts, pensions, savings, and annuities can all play a role in your overall strategy.

But how do you know what to use—and when? This is where a financial professional can help you assess your situation and recommend the right mix to meet your needs.

For example, we know that Medicare is not likely to cover all healthcare related costs in retirement, so savings could be reserved for everyday expenses. While an annuity might provide a predictable income stream specifically to help pay for healthcare needs.

Working with a financial professional can help you create a strategy that aligns with your goals, so you can cover your basic needs and afford the medical care you may require.

Meeting Long-Term Care Needs

Long-term care costs can add up fast.

Nursing home or assisted living expenses often reach thousands of dollars per month. While costs vary by location, amenities, and more, according to A Place for Mom’s 2024 proprietary data, the national median cost of assisted living in 2024 is $4,995 per month.2 The median cost of a private nursing home room in 2024 is an annual cost of $120,304 and $107,146 for a semiprivate room.3

Traditional long-term care (LTC) insurance is one option for covering these costs, but high premiums have made it less accessible for many.

Annuities with riders for terminal illness, chronic illness, or long-term care—and life insurance policies with living benefits—offer more versatile solutions.

Unlike traditional LTC policies, they’re not “use it or lose it.” Even if you never need long-term care, the funds can still support other financial goals.

CONSIDER THIS:

A fixed indexed annuity could provide enhanced payouts if long-term care becomes necessary— often at no additional cost. And you aren’t out anything if you don’t end up needing the benefits.

Evaluating multiple options with the guidance of a financial professional can help you build a plan that fits your needs and offers greater financial security for the future.

Planning for healthcare expenses in retirement is essential, and annuities can play a valuable role.

Explore how Guaranty Income Life annuities can help you achieve your retirement goals.