Legacy Planning

Are you looking for more clients?

Legacy planning offers a powerful opportunity. Financial professionals often focus on high-net-worth clients for estate planning, but there’s a large group of middle-income families and their heirs (the next generation) who need help planning a financial roadmap to protect what they’ve built and pass it on to loved ones.

Offering legacy planning could allow you to meet this need and help unlock new lead sources.

The typical American may think estate planning is only for the wealthy, but legacy planning speaks to some real needs of the middle-income market.

When people hear “estate planning,” they often think of grand estates, large inheritances, and a service reserved for the very wealthy.

They might think of high-powered lawyers managing a vast portfolio of assets or setting up complicated trusts. For many middle-income families, this can feel out of reach or irrelevant.

Concept

Legacy Planning goes beyond distribution of assets.

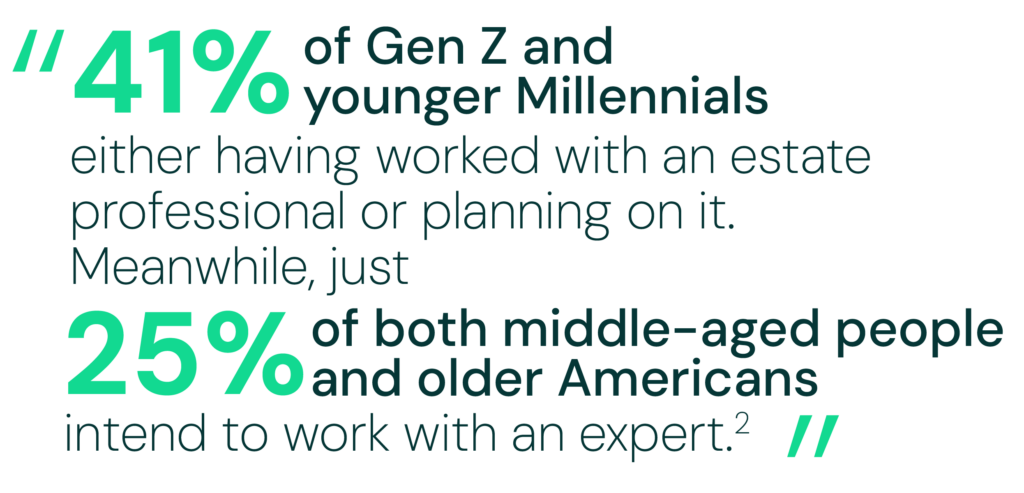

“41% of Gen Z and younger Millennials either having worked with an estate professional or planning on it. Meanwhile, just 25% of both middle-aged people (35-54) and older Americans (55 and over) intend to work with an expert.”2

Wills, trusts, powers of attorney, long-term care planning, and gifting are essential tools for hard-working clients.

Middle-income clients may not have vast amounts of wealth, but they have a strong interest in their family’s financial security. As of 2022, the median household income of the “middle class” is up to $106,000, according to Pew Research.1

These clients have worked hard to build their lives. And their homes, savings, and retirement assets represent everything they’ve accomplished. For these clients, legacy planning is about helping ensure their family’s future stability and protect the things that matter most to them.

For you, offering these services strengthens your role as a trusted financial professional, opening doors to deeper client relationships and long-term growth for your business.

Wills: Many clients with modest assets mistakenly believe they don’t need a will. However, a will is essential for making sure their home, personal belongings, and savings are passed on according to their wishes. Without one, their estate could go through a lengthy probate process, and their state of residence may decide how to distribute their assets. A simple will can prevent disputes and ensure your clients’ wishes are honored.

Living Wills: While most people think of a will as a document for after they pass, a living will addresses their preferences for medical care if they become incapacitated. This is especially relevant for middle America who may not have the luxury of endless resources for long-term care. A living will helps ensure your client’s family isn’t left guessing about life support or specific medical treatments in a crisis.

Trusts: Trusts can be a powerful tool regardless of net worth. For example, a simple revocable living trust allows clients to avoid probate, providing more control over how their estate is handled. This is especially useful for distributing an inheritance in a controlled manner for beneficiaries of varying financial conditions and abilities.

Power of Attorney (POA): Many people may overlook the importance of a power of attorney document until it’s too late. A POA can be a huge relief for families during times of illness or incapacity, allowing them to pay bills, manage finances, and handle important legal matters without delay. It helps prevent financial chaos and ensure that the family’s affairs run smoothly.

Long-term Care Planning: For many everyday Americans, long-term care can be a significant financial burden. Legacy planning should also include considerations for long-term care needs to ensure clients don’t drain their savings due to unexpected medical or caregiving costs. This helps protect the financial security of families in the long run.

Charitable Giving: Charitable giving can be an impactful part of legacy planning. This may include making donations to favorite causes, establishing charitable trusts, and providing support to their community long after they’re gone. For many, giving back becomes a meaningful part of their legacy, providing lasting value to both their family and society.

By incorporating these essential elements—wills, philanthropy, trusts, powers of attorney, and long-term care planning—you provide clients with a comprehensive strategy that helps address their real-life concerns.

There are a few practical steps you can take to incorporate legacy planning in your practice.

Here’s how you can begin incorporating legacy planning in your practice:

- Ask family-centered questions: Instead of focusing only on assets, ask clients about their family, future goals, and what matters most to them. For example, you could ask, “What do you want for your family’s financial future?” or “How can we make sure your values are passed down to your children?” These questions open up deeper conversations and lead to more personal connections.

- Include both spouses: If clients are married, ensure that both spouses are involved in the planning process to foster stronger relationships and trust. You could say something like, “Let’s make sure both of you feel comfortable with how your legacy will be handled.” This creates trust and greater confidence in the decisions, which fosters stronger, longer-lasting relationships with your clients.

- Connect with the next generation: Engage clients’ children early to secure long-term relationships and create multi-generational planning strategies. You could suggest a family meeting where both parents and children discuss a legacy plan together, giving everyone a sense of involvement and continuity.

By providing this service to everyday Americans, you deliver a service that’s both practical and essential while generating new leads and referrals for your practice.

The next generation are already at the age where they can benefit from financial guidance, even before inheritance.

Clients aren’t just thinking about their own future—they care about their children and grandchildren too.

Legacy planning creates a natural bridge between current clients and their heirs. The parents are your primary clients, but because you’ve involved the children in the legacy planning process, you can begin building relationships with younger generations long before assets transfer.

Millennials, currently aged 27 to 43, and Gen Z, aged 11 to 26, are at pivotal stages in their financial journeys. Millennials are in their prime working years, buying homes, and building families, while older Gen Z are entering the workforce. Both generations are of the ages where they can benefit from the guidance of a financial professional.

Consider this: “41% of Gen Z and younger Millennials either having worked with an estate professional or planning on it. Meanwhile, just 25% of both middle-aged people (35-54) and older Americans (55 and over) intend to work with an expert.”2

Legacy planning is a strategy for growing your practice.

Even before inheritance comes into play, these younger generations need help making smart financial decisions. The relationships you cultivate with them today through legacy planning form the foundation of long-term loyalty and a steady source of new clients.

1 The American Middle Class – Key Facts, Data and Trends Since 1970 | Pew Research Center

2 Coining a legacy: How Americans plan to leave their mark | Empower

Want to grow your practice by solving real problems for everyday Americans?

Give the Guaranty Income Life sales desk a call at 800-535-8110 for resources to help enhance your client interactions and build a thriving practice.