Estate and Legacy Planning

Essentials for financial advisors to nurture lasting relationships with their clients’ heirs and beneficiaries.

- Engaging heirs for a prosperous future

- The benefits of early engagement

- How to approach heirs and beneficiaries

Estate and Legacy Planning

Essentials for financial advisors to nurture lasting relationships with their clients’ heirs and beneficiaries.

- Engaging heirs for a prosperous future

- The benefits of early engagement

- How to approach heirs and beneficiaries

Engaging heirs for a prosperous future

A tectonic shift is taking place in the world of wealth management. Over the next 25 years, approximately $60 trillion in assets will change hands, presenting financial advisors with a unique challenge and opportunity.

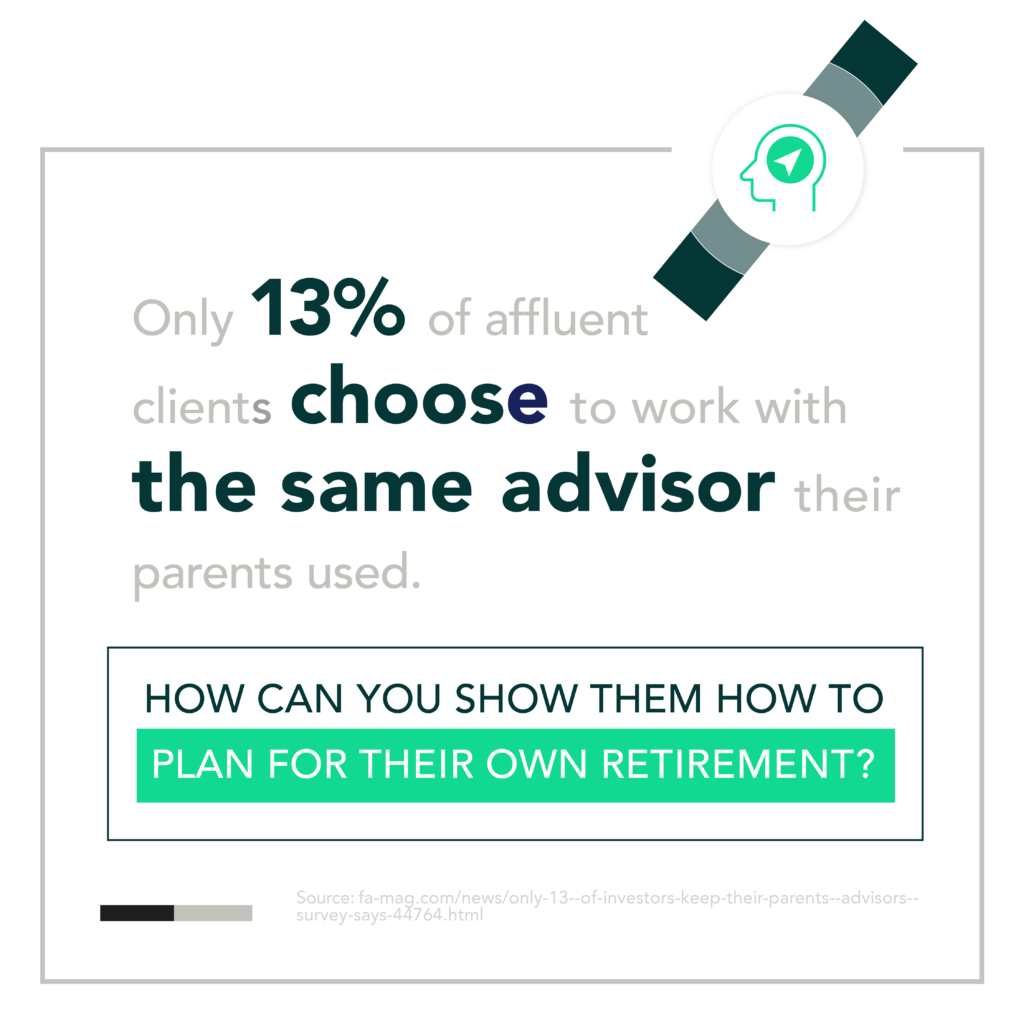

Studies, including those conducted by Cerulli Associates, show that only 13% of affluent investors continue working with their parents’ advisors. That means 87% of hard-won assets and relationships move needlessly between firms. For the savvy advisor the path to sustainable growth may lie in effectively engaging with a client’s heirs.

The benefits of early engagement

Early engagement with heirs is about more than simply maintaining assets under management—it’s about facilitating financial literacy and stability for future generations. When you start conversations early, you could set the stage for a long-term relationship that extends beyond your initial client. Your clients will likely appreciate you going the extra mile with their loved ones.

Plus, you secure the future of your practice by cultivating a robust client base that potentially endure across generations. You have an opportunity to extend the trust and loyalty you’ve already built to captivate and retain the next generation.

How to approach heirs and beneficiaries

Reaching out to heirs and beneficiaries is not a one-size-fits-all task. It requires tact, empathy, and a keen understanding of individual needs and circumstances. Start with open discussions about the future, weaving in financial education and facilitating intergenerational dialogues. Remember, success lies not in talking but in listening and understanding.

How Guaranty Income can help

At Guaranty Income Life, we are committed to providing practical solutions for legacy planning. With our tools, including a comprehensive client worksheet, you can streamline the estate planning process and ensure no important detail is overlooked.

- Estate planning can be a holistic process that may offer peace of mind to your clients, knowing that their wishes will be honored and their heirs well cared for.

- We can deliver more information and tools to help facilitate better conversations with clients and their heirs. We also offer a client worksheet designed to guide the planning process.

- Avoid unnecessary taxes and unnecessarily lost AUM.

Are you ready incorporate additional value in retirement planning?

Reach out to our sales desk at 800-535-8110 for more information and ideas on how you can amplify your practice and better prepare clients to transition from work to retirement.