Position Annuities for Today’s Retirement Needs

Annuities As The “Modern Pension” For Retirement Income

“Like pensions did for past generations, annuities offer a unique opportunity – especially for middle and working-class Americans – to have the peace of mind knowing they’ll always have a source of guaranteed income in retirement.”2

– Cyrus Bamji, Chief Strategy Officer, ALI

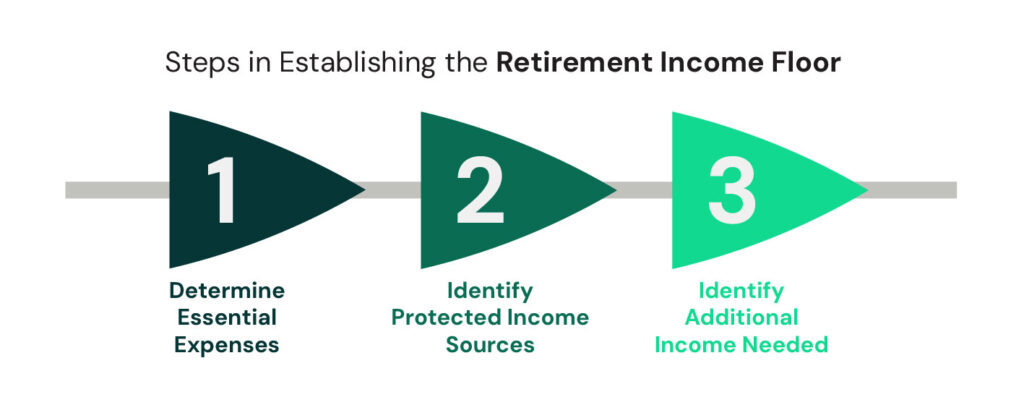

Annuities help build that income floor, complementing Social Security and providing protection against inflation, market volatility, and longevity.

By allocating a portion of a client’s portfolio to guaranteed income, financial professionals can simplify income planning and give clients greater confidence about the future.

Highlight annuity growth potential

and protection from market loss

Many clients still need to grow their retirement savings—but can’t afford to take on more risk. Annuities offer market-linked growth potential with downside protection, renewal rate integrity, and indexing strategies that help clients pursue long-term accumulation goals in any market environment.

Annuity Positioning Materials

For Use With Clients:

Reduce retirement risks with

a fixed indexed annuity

Market volatility, poor withdrawal timing, and longer life spans can all threaten retirement security. A fixed indexed annuity can help reduce these risks by protecting against losses, providing reliable income during downturns, and offering lifetime income clients can’t outlive.

Insights for Financial professionals

Why Providing Financial Education is One of Your Best Tools for Next-Gen Client Retention and Growth

How financial education helps financial professionals grow their practice by retaining heirs, attracting Next Gen, and protecting assets across generations.

Annuities: One of the Biggest Retirement Blind Spots

As financial professionals, we have a shared responsibility to help clients build the knowledge they need to make confident retirement decisions. Learn how to educate the next generation clients about annuities.

How Legacy Planning Can Help Financial Professionals Tap Into New Lead Sources

Legacy planning offers a powerful opportunity. Financial professionals often focus on high-net-worth clients for estate planning, but…

Choose the right annuity for your clients’ financial goals

Explore how our annuities can help your clients grow and protect their retirement savings.

Not all products may be available for your organization. For details on available options, please contact your IMO or the Guaranty Income Life sales desk at 800-535-8110.

Explore more strategies to maximize impact and improve client engagement

Ready to incorporate additional value

into retirement planning?

Reach out to your IMO or Guaranty Income Life sales desk at 800-535-8110.