Retirement planning

Social Security Strategies

Why it is important to talk About social security in retirement planning

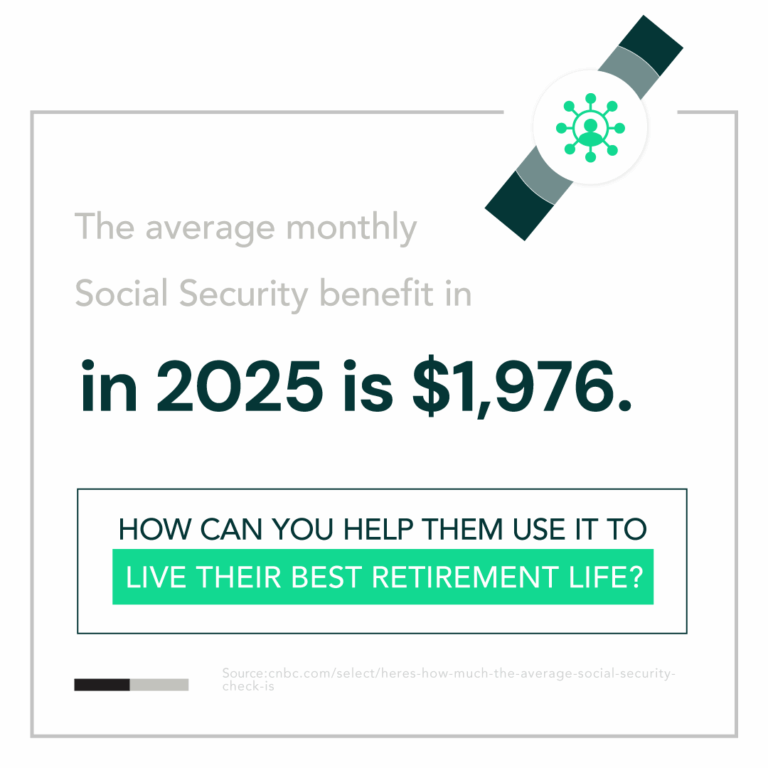

Did you know that 60% of Americans plan to rely on social security as their main source of income and that the average monthly Social Security benefit in 2025 is $1,976. The need for clients to have a complete financial plan has never been greater. Having high-level Social Security planning conversations may enhance the client experience and set yourself apart from the competition.

How could Social Security Strategies help your clients?

Social Security claiming strategies in retirement plans could assist clients in seeing a clearer picture of what they will receive in retirement. In a time when every dollar matters, helping clients avoid surprises is a great way to demonstrate knowledge, build trust and help cement a long-standing relationship.

Approaching The Conversation

Starting the conversation can be as simple as asking clients if they have estimated their Social Security benefits. There are tools available to help calculate benefits directly from the Social Security Administration’s website. In just a few minutes you can provide your clients with another piece of the retirement puzzle. You don’t need to be an expert to help clients leverage Social Security benefits in their favor.

The role of a financial professional

Your role extends beyond helping clients achieve their financial goals. As you discover their needs, build rapport, and uncover suitability, you also have the opportunity to initiate conversations about their vision for retirement that extend beyond the financial aspects. By doing so, you can help them align their financial plan with personal aspirations, ensuring a retirement that is both financially stable and personally rewarding.

Delving into the personal aspect of retirement planning may set you apart in a crowded marketplace. By going the extra mile to help your clients articulate and plan for their non-financial retirement goals, you’ll have opportunities to build deeper, more meaningful relationships, foster client loyalty and help enhance your reputation as a comprehensive retirement advisor. The ripple effect of this client-centric approach may lead to more referrals and sustainable growth for your practice.

How Guaranty Income Life can help

Social Security can be daunting to understand. At Guaranty Income Life, we know how crucial it is to connect with your clients and explain the complexities of these important topics. We’ve compiled resources like Maximizing Social Security Benefits to help you feel more confident about the topic.

Materials To Help Clients

Prepare and Plan Their Future

Ready to incorporate additional value in retirement planning?

Reach out to our sales desk at 800-535-8110 for more information and ideas on how you can amplify your practice and better prepare clients to transition from work to retirement.