GILICO offers specialized deferred annuity plans that will allow you to increase your earning potential and be well prepared for retirement and also for life’s unexpected emergencies. At GILICO, we work hard to ensure that you’re prepared today, tomorrow, and in the future.

Products

GILICO offers customized long-term financial plans that provide individuals and families with financial success now, tomorrow, and in the future.

Our primary focus is on deferred annuity products for growth and retirement income. Knowing that one policy does not fit all, we offer multiple product offerings to meet different needs. Doing so provides our customers with the flexibility to select the best solution for their financial goals.

Guaranty Growth Plus Annuities

Guaranty Growth Plus (GGP) is a Single Premium – Tax Deferred – Fixed Indexed Annuity designed to protect assets from market downturns and grow retirement savings. In addition to safety and growth, it offers the option to have a Guaranteed Lifetime Income for you and your spouse.

GGP is currently available through a select group of advisors. Please call 800-535-8110 to get contact information for a licensed professional in your area.

We continually invest in innovation. Please ask about our future product offerings.

Important Information about Deferred Annuities

Tax Status of Annuities

Qualified – Qualified Annuities are purchased with before-tax dollars through tax-qualified retirement plans, including the following:

- IRAs

- TSA (403-b)

- SEPs (Simplified Employee Pension Plan)

- Pension Plans (Defined Contribution and Defined Benefit)

Non-Qualified – Non-Qualified Annuities are purchased with after-tax dollars and the premiums are not tax deductible. Some important things to know include the following:

- Income taxes have been paid on the principal.

- Funds may be in a checking or savings account.

- These annuities are often funded with transfers from CDs, mutual funds, stocks, or money market funds.

- There are no tax deferrals on corporate-owned annuity earnings.

- Life insurance proceeds are often placed in annuities, to be held tax deferred until payment at a later time and to provide immediate income for beneficiary’s lifetime or for a certain period.

*Qualified and Non-Qualified Money cannot be deposited into a single annuity.

The Four Basics of Annuity Taxation

-

Withdrawals

You will pay taxes only when interest is withdrawn. Withdrawals from annuities are taxed in one of two ways depending upon when the annuity was issued. Annuities issued prior to August 14, 1982 had FIFO accounting (first in, first out). Since principal was first in, it came out first, tax-free. With annuities issued on August 14, 1982 and thereafter, taxation changed to LIFO (last in, first out). Simply put, withdrawals are now taxable since interest is withdrawn first. Many of your clients will appreciate paying taxes only when interest is withdrawn since most of them are now paying taxes on interest even if they don’t withdraw it.

-

The 10% Excise Tax Penalty

Just like an IRA, there is a 10% excise tax penalty on premature withdrawals. The government extends tax advantages to the annuity for retirement purposes. The government also extends tax disadvantages to taxpayers who do not use the annuity for retirement. All interest withdrawn by the annuitant prior to reaching the age of 59-1/2 will be subject to a 10% excise tax penalty.

Are there exceptions? Yes. Here are some of the most common:

-

- Age 59-1/2 or older withdrawal

- Disability of taxpayer

- Distribution from a pre-August 14, 1982 annuity

- Death of owner (may not be owner’s preference)

- Payout from an immediate annuity

- Substantially equal payments over taxpayer’s life expectancy

-

-

The Exclusion Ratio

When and if the owner annuitizes (applies their annuity value toward a payout option), the annuitant will receive equal monthly payments. An exclusion ratio is applied to each payment received. A percentage of each annuity payment is considered a return of the owner’s cost basis (principal) and is tax-free. The balance is taxable.

-

1035 Exchanges

One unique tax advantage with annuities is that you can transfer money from one annuity to another annuity income tax-free. The provision in the Internal Revenue Code that allows this is section 1035(a). However, great care should be exercised when making a 1035 exchange including the following:

- Beware of surrender charges when making an exchange.

- Exchange the entire annuity when possible. In many cases, you cannot transfer a portion of the annuity. Some insurance companies (including GILICO) will accept and make partial 1035 exchanges.

- If there are loans outstanding, repay all loans before exchanging.

- Parties designated in the old contract as owner, annuitant, and beneficiary must be the same in the new contract. “Joint owners” in the old contract must retain their same percentage ownership in the new annuity contract.

- You should consult with your tax advisor before making the exchange.

Just Say NO to 1099’s

Nothing beats the power of tax-deferred growth. If you are just reinvesting the interest from your CD, you’re losing out on 33% of your growth.

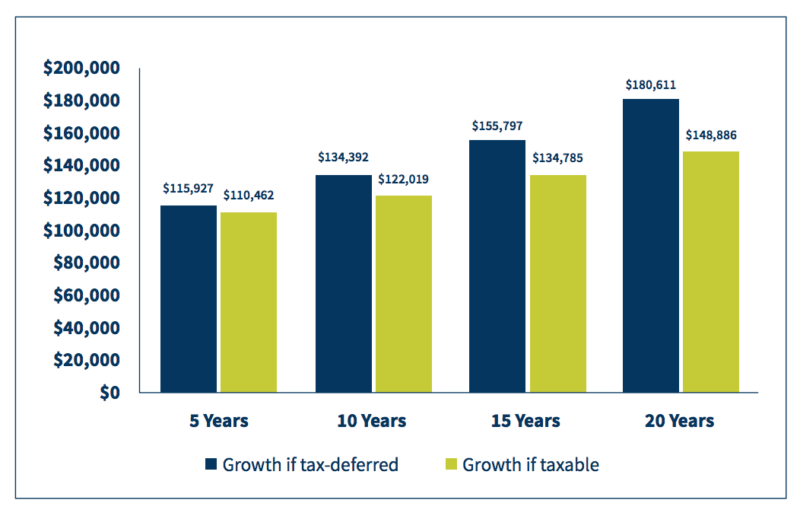

Unlike a bank CD, an annuity offers interest that grows tax-deferred. No income taxes are due until the funds are withdrawn. The graph below shows the difference this tax-deferred advantage can make. If you are still paying taxes on your interest, you’ll be pleased to know that there is a sensible alternative.

This calculation assumes $100,000 invested at 3% effective annual yield tax-deferred compared to 3% EAY in a 33% tax bracket.

With a GILICO annuity, you can take advantage of triple compounding, including the following:

- Earning interest on your money.

- Earning interest on your interest.

- Earning interest on the money you would have lost in taxes.

When does 3% = 4.48%? When you’re in a GILICO tax-deferred annuity!

This table shows you at a glance the interest rate a bank CD (or other taxable savings product) would have to generate to equal the net earnings of a tax-deferred annuity. Unless your CD is an IRA, the interest is taxable even if it is left on deposit with the bank.

Table of “Equivalent After Tax Yields”

| Rate for Tax-Deferred Annuity | Equivalent CD Rate in a 33% Tax Bracket |

|---|---|

| 3.00 | 4.48 |

| 3.25 | 4.85 |

| 3.50 | 5.22 |

| 3.75 | 5.60 |

| 4.00 | 5.97 |

| 4.50 | 6.72 |

| 5.00 | 7.46 |

| 5.25 | 7.84 |

| 5.50 | 8.21 |

| 5.75 | 8.58 |

| 6.00 | 8.96 |

| 6.25 | 9.33 |

| 6.50 | 9.70 |

| 6.75 | 10.07 |

| 7.00 | 10.45 |

Formula for After Tax Yields:

GILICO Annuity Rate

1 – tax rate

= Equivalent After Tax Yield

Example:

3% Annuity Rate

1 – .33 = .67

= 4.48% Equivalent Yield

Are you Tired of Paying Taxes on Your Social Security Benefits?

Did you know that you could be paying taxes on up to 85% of your Social Security benefits?

If your combined income (50% of your Social Security payments, plus all other income (including tax-exempt interest)) is between:

Married filing jointly:

$0 – $32,000: None of your Social Security benefits are taxed

$32,001 – $44,000: Up to 50% of your Social Security benefits are taxed

$44,001 and over: Up to 85% of your Social Security benefits are taxed

Case Study:

| Income: | |

|---|---|

| Pension Income*: | $24,000 |

| Dividend Income*: | $4,000 |

| Muni Bond Income*: | $3,000 |

| Bank CD Interest Income*: | $8,000 |

| Social Security Income: | $11,000 |

| Total Assets: | $50,000 |

| Combined Income Formula | |

|---|---|

| Pension Income: | $24,000 |

| Taxable Income: | $15,000 |

| 50% Social Security Benefits | $5,500 |

| Combined Income: | $44,500 |

*Optional Income

In the above example, the total income of $50,000 exceeds the $44,000 limit for married couples, and therefore this family is paying tax on 85% of their Social Security benefits. If they aren’t living off their investments, a GILICO annuity is a much better place for their money.

Do You Want Your Heirs to Get More of Their Fair Share

Another important benefit of an annuity becomes apparent should the annuitant or owner pass away. At death, the value of a GILICO annuity (with properly designated beneficiary other than the annuitant’s estate) is passed on to heirs without the expense, delay, and frustrations of probate.

Proceeds from a non-IRA bank CD, on the other hand, can be subject to:

- Loss of Money – probate administrations fees up to 10%

- Time & Frustration – delays up to two years while the courts settle the estate, and

- No Privacy – potential public inspection because a decedent’s assets are public record

What Happens to My Money If I Die?

When Owner and Annuitant are the same person, the money goes directly to the BENEFICIARY

Options if HUSBAND or WIFE is Sole Beneficiary:

-

- Change Name of Owner – Annuity Continues – No Tax Due (Spousal Continuation)

- Cash Annuity In – May have a Company Penalty – Taxes Are Due

- Periodic Pay Out – No Company Penalty – Tax Due As Received

Options if Any OTHER PERSON or ENTITY (Estate,Trust, etc.) is beneficiary:

- Cash in – May have a Company Penalty – Taxes are Due

- Periodic Pay Out – No Company Penalty – Tax Due as Received

- Payout Period May Not Exceed Life Expectancy of Individual Beneficiary

- The Decision Must Be Made Within 60 Days After Death of Annuitant or Owner

- Payments Must Begin Within 1 Year of Death

IMPORTANT INFORMATION FOR ANNUITY DEATH BENEFITS

- Annuities Avoid PROBATE Costs and Delays

- Annuity Value is Includable for Estate and Inheritance Taxes.

- Interest Income is Received as “Income in Respect of Decedent.”

- Deduction is Allowed Against Income for Estate and Inheritance Taxes.

- The Only Way to Get An Asset Out of An Estate Is to Give It Away.

- The Decision is one of “Control & Pay Tax” or “No Control & No Tax.”

How Annuities Compare to “the Competition”

| Feature | Annuities | IRAs | CDs | Muni Bonds | Govt. Bonds | EE Bonds |

|---|---|---|---|---|---|---|

| Tax Deferral | Yes | Yes | No | N/A | No | Yes |

| Tax-Free | No | No | No | Yes | No | No |

| Tax-Deductible | No | Yes | No | No | No | No |

| Market Risk | No | Yes | No | Yes | Yees | No |

| Safety of Principal | Safe | Varies | Safe | Varies | Safe | Safe |

| Surrender Charge(s) on Early Withdrawal | Based on Contract | Possible back-end sales charge | Penalties on interest | None | None | Moderate |

| Tax Penalties on Early Withdrawal | Possibly harsh | Possibly harsh | None | None | None | None |